Happening NOW with BFIA

-

Quizzes

Test student progress and financial understanding with quizzes for Division III and Division IV classes.

-

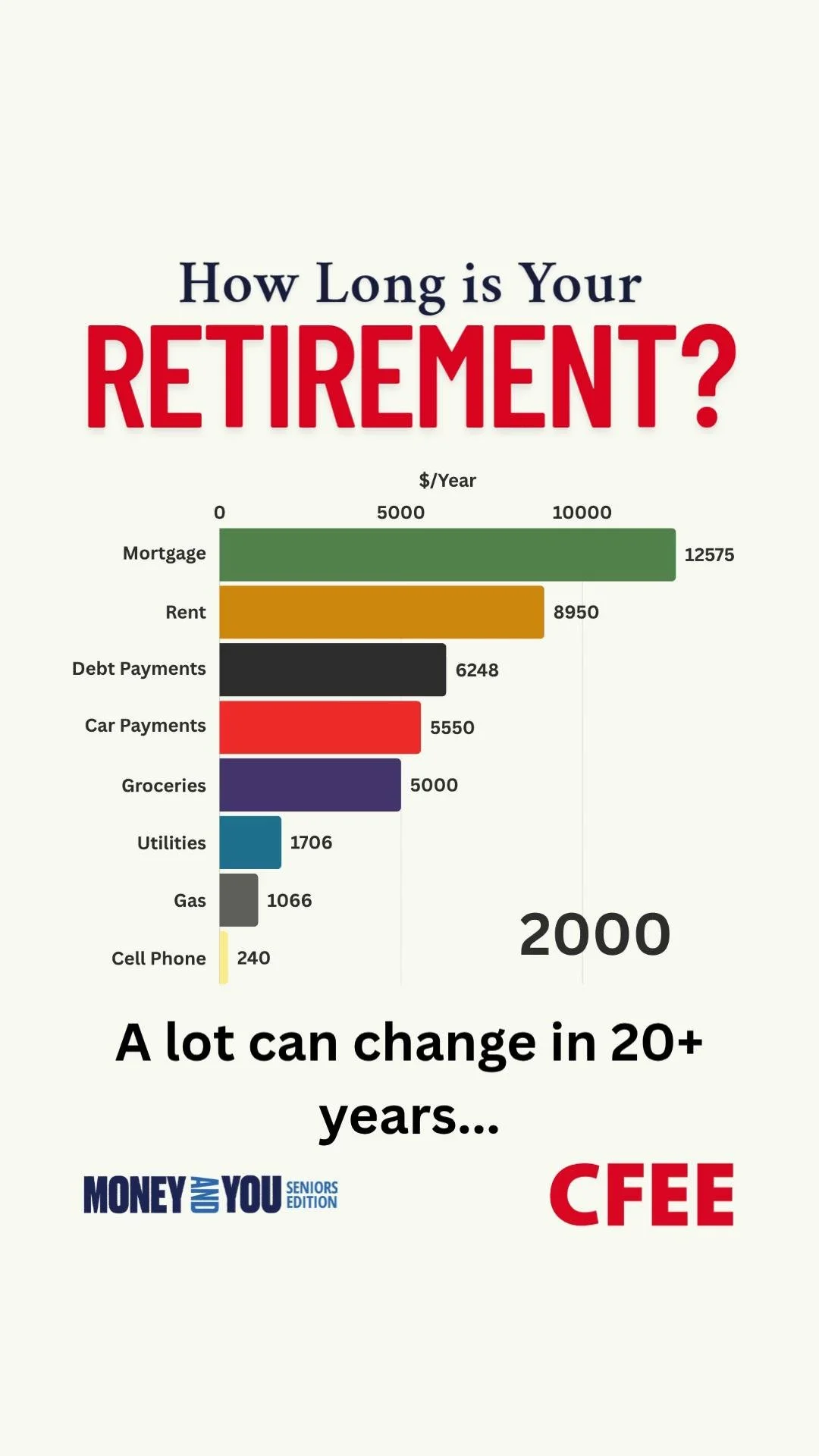

It's Time for Cash Class!

CFEE’s “Cash Class” is a series of videos that animate financial literacy education. Through real-life scenarios, challenging obstacles, and thought-provoking reflections, these videos reinforce the lessons learned in class.

Support | Prepare | Build

The goal of the Building Futures in Alberta program is to support Alberta Teachers. Together, we can help prepare students to undertake their future economic and financial decisions with confidence and competence and build a healthy financial future.

What Albertans are saying!

Get Social With CFEE!

We’re Here to Support!

Send us a message to learn more about our programs, how you can integrate BFIA into your learning plans, and more!